THE SCREENING REPORT(s) SOLUTION BASED ON THE AUTOMATED COMPLIANCE CHECKER'S FINDINGS IS PROVIDED AS A COMPLIANCE AS A SERVICE (CaaS)

The Automated Compliance Checker as a Service for Proxy Circular (aka MIC) Disclosure is an important resource for corporate teams to:

- address and minimize inadvertent errors and omissions,

- identify and quantify risks that may arise from possible non-compliance with applicable disclosure regulations and best practices,

- evaluate whether the disclosure document should be updated or completed as well as

- benchmark the Issuer to its peers on key aspects.

Launched to help corporate teams avoid the repercussions of inadvertent non-compliance, the Compliance as a Service (CaaS) provides Proxy Circular (aka MIC) SCREENING REPORTS based on the Automated Compliance Checker's findings as it screens the disclosure document.

The Automated Compliance Checker can detect relatively high risk issues and is sensitive to the principle that specificity is required, not boilerplate disclosure.

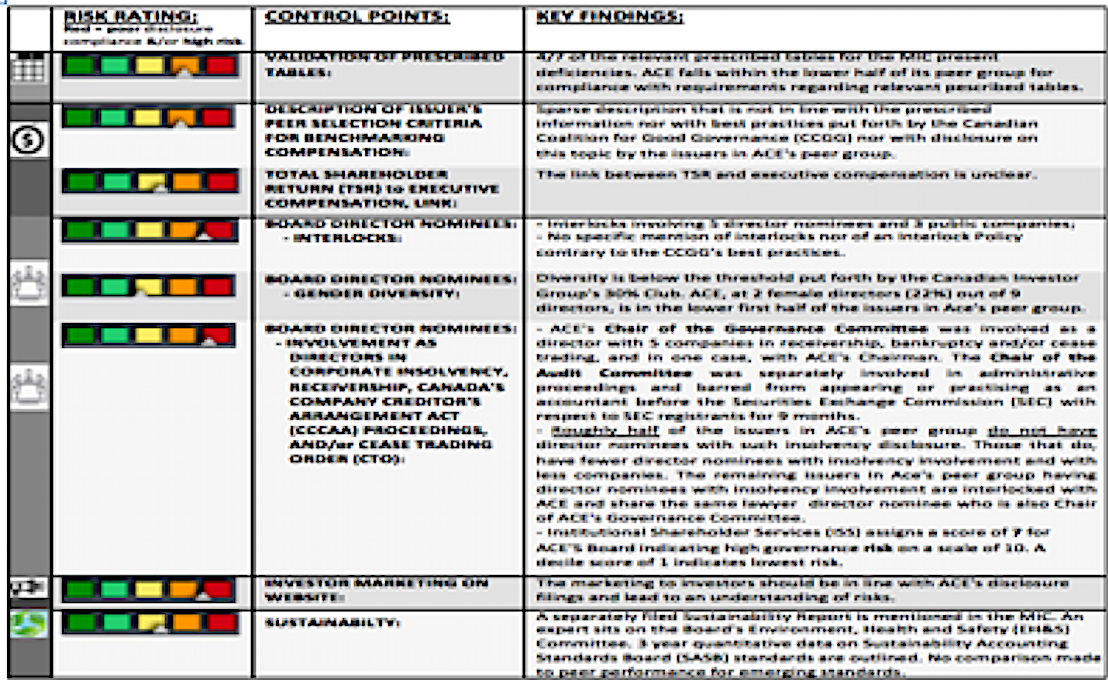

Proxy Circular (aka MIC) SCREENING REPORTS spotlight areas of concern in the disclosure documents and provide risk ratings and key findings for each of the control points found to show relatively high risk or poor disclosure.

To help Issuers gauge their level of compliance with Continuous Disclosure regulations, the Automated Compliance Checker focuses on analyzing the Proxy Circular (MIC) disclosure on Environmental, Social and Governance matters, including 5 key control points, the:

- Audit and validation of relevant prescribed tables;

- Bench-marking of compensation to Issuer's peer group;

- Board and its Committees;

- Investor marketing on the website;

- Sustainability and other areas including Diversity, Equity and Inclusion (DEI) & Auditor Independence.

The findings outlined in the SCREENING REPORT can assist:

1. Corporate teams in identifying and addressing inadvertent errors and omissions thus minimizing the risk of negative consequences that may follow for the Issuer if left unattended, including possible lower ratings by analysts, letters from the authorities, cease trading orders and reputational damage, for example. Developed as a customized service, the Automated Compliance Checker Service is meant to offer Corporate teams cost-effective options tailored to address the needs and circumstances of the Issuer they work for

2. Board, its Committees and the C-suite in making better informed decisions using data; in tracking the Issuer's performance over time or against competitors; and helping see patterns using the graph provided with Screening Reports.

3. Analysts and Asset managers in evaluating ESG risk as it relates to investments. Analysts must often sift through piles of disclosure documents. Hence, Screening Reports are a great efficiency optimizer.

4. Market Authorities to screen more Issuers and gather data.

5. Litigators and Shareholder activists eager to efficiently discover any anomalies following stock drops or reputational damage.

The SCREENING REPORT(s) are based on the Automated Checker's findings and are provided as a Compliance as a Service (CaaS) for Proxy Circulars (MICs) disclosure filings.

A SAMPLE SUMMARY SCREENING REPORT including Risk Ratings for each of the Control Points and Key Findings is illustrated below.

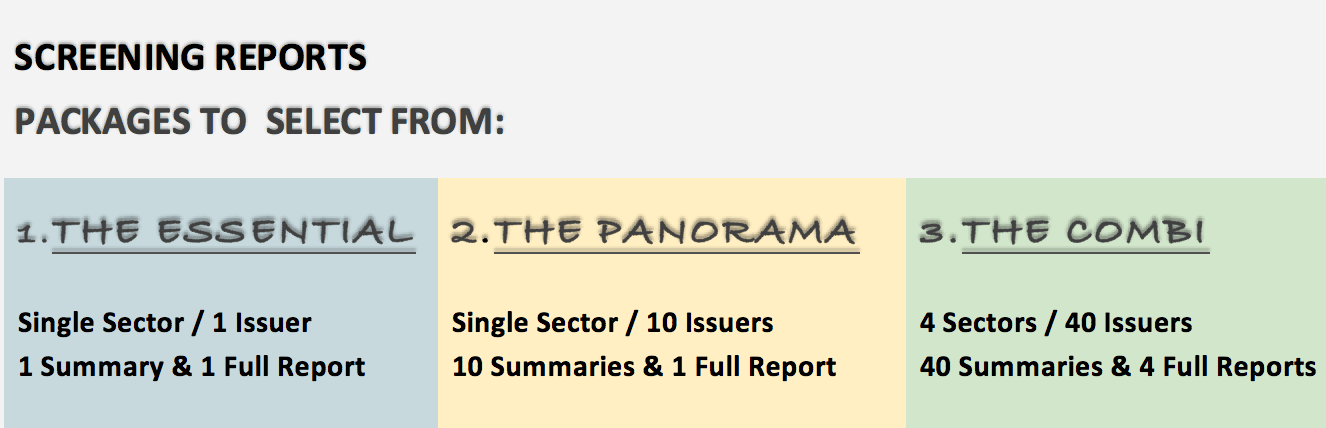

packages to select from are set out in the illustration below.

For more info, contact

edda@regsol.tech

A stitch in time may save nine...

Compliant corporate reporting that promotes confidence and enables investors and shareholders, including asset managers, to make informed investment decisions is an important part of fair and efficient capital markets.

The Proxy Circular or Statement (aka the Management Information Circular or MIC) is one of the key reporting documents filed by Issuers. The Proxy Circular (aka MIC) focuses on governance-related matters including reporting on board director nominees, board succession planning, director and executive pay and incentives, auditor independence and critical emerging issues.

Environmental, Social and Governance (ESG) practices are increasingly recognized as a determinant of company performance and hence of its investment value. Poor governance is considered an investment risk.

The "say on pay" feature mandatory in most G7 countries has mobilized activist investors. No company wants to appear in a negative light in a newspaper headline. A relatively poor rating by Institutional Shareholder Services, for example, can put off investors and impact share price.

As Investment analysts and stakeholders are paying closer attention to the Proxy Circular (MIC), corporate teams are giving more attention to the quality of their disclosure in the Proxy Circular.

Substantial costs and efforts in preparing the continuous disclosure filings followed the introduction of the Sarbanes-Oxley Act in 2002 in response to the Enron and WorldCom accounting scandals. In 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act to monitor financial stability of major financial firms and systemic risk was enacted as a response to the 2008 financial crisis.

Today, most large investment funds emphasize the importance of sustainability and that necessarily implies a long-term outlook. Both private and public companies share sustainability concerns as do policy makers and regulatory authorities.

The nature of director stewardship and the purpose of the corporation are being re-examined and are hot topics discussed by policymakers. Director E&O insurers are taking a closer look to ensure premiums are appropriate to a potentially growing liability.

The Automated Compliance Checker's findings can spotlight relatively high risk issues and the Checker is sensitive to the principle that specificity is required, not boilerplate disclosure.

The findings output in the form of a SCREENING REPORT as shown in the sample Screening Report illustrated below* in the Summary format is not exhaustive, nor does the Automated Compliance Checker benefit from deep knowledge of the Issuer.

The findings in the SCREENING REPORT can assist corporate teams in identifying and addressing inadvertent errors and omissions thus minimizing the risk of negative consequences that may follow if left unattended, including possible lower ratings by analysts, letters from the authorities, cease trading orders and reputational damage, for example.

For more information about the Automated Compliance Checker's Screening Reports for Proxy Circulars (aka MICS); for a sample Summary Screening Report; and more info on the Packages to select from (illustrated above), please reach out at edaa@regsol.tech

The information and comments herein are for the reader's general information and are not intended as advice or opinion to be relied upon in relation to any particular circumstances. Professional specialist advice should be sought by the reader about particular application of the law to specific circumstances.

* ILLUSTRATION OF A SAMPLE "SUMMARY SCREENING REPORT" INCLUDING "RISK RATINGS" FOR EACH OF THE "CONTROL POINTS" & "KEY FINDINGS". This same illustration as the one that appears above appears again here for convenience.